Compulsory Third Party (CTP) Compensation Statistics

In Queensland, CTP insurance enables people who are injured in motor (and pedestrian) accidents through no fault of their own to claim fair and timely compensation and access rehabilitation. The compensation paid to the person who was injured depends on the extent of their injuries resulting from the accident and how these injuries affect their work and social functioning. In 2020–21, the majority of compensation for these accidents was allocated to economic loss, care and medical expenses.

Compensation $886 Million

In the 2020-2021 Financial year $886 million in payments was made to individuals by CTP Insurers for accident compensation, with an average settlement amount of $43,663. The majority of this compensation was for economic loss as seen in breakdown of these payments:

Compensation to individuals

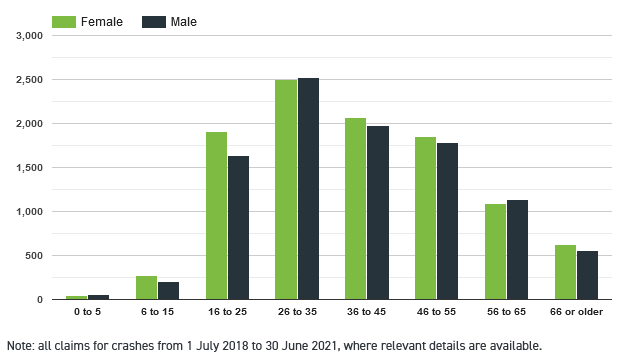

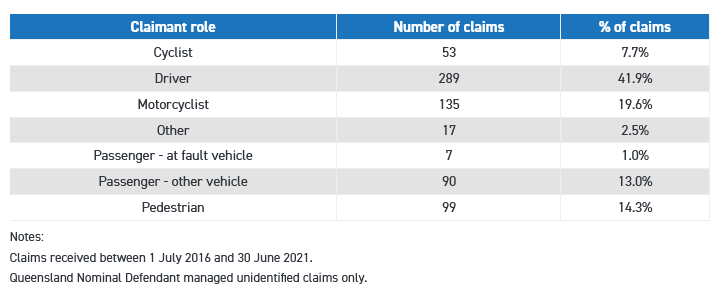

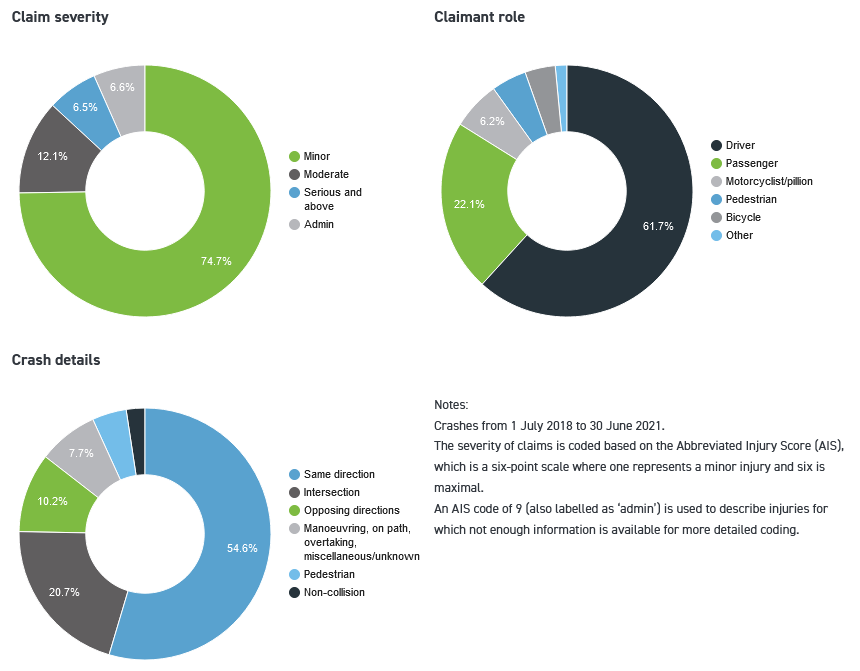

The compensation payments cover the needs of a wide range of people of different ages, genders, types of crashes and roles in crashes:

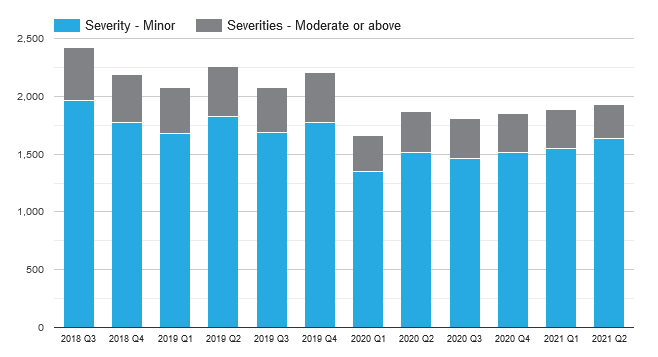

Types of Accidents & Claims

Currently, the most common claim type is from drivers experiencing minor injury from a crash where vehicles were travelling in the same direction. In terms of location approximately 82% of accidents occurred in South East Queensland (SEQ), with the remaining 17% occurring throughout the rest of Queensland.

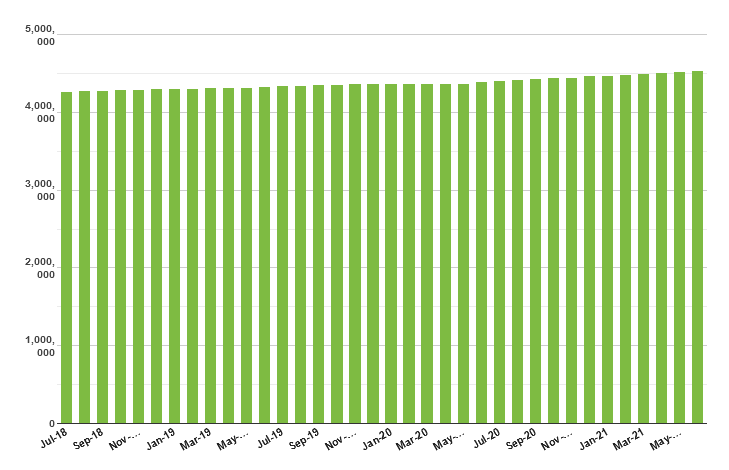

More cars and more claims

With more cars on the road there are more claims. With 2020-2021 Financial Year seeing a 3.66% increase in overall registered vehicles:

Source: Motor Accident Insurance Commission (MAIC) Annual Report 2020-2021.